Not Your Keys, Not Your Coins!

Welcome to your in-depth primer about the crypto craze.

A "heads up" before you start FoolProof's crypto module:

Even the smartest young person is prone to disaster when they jump into the crypto maze.

We're talking major financial loss due to risky investments, scams and hacks.

Add in some Altcoin vs. Token vs. Stablecoin? Blockchain, Decentralized Finance (DeFi), Mining, or Smart Contracts? How about Non-Fungible Tokens (NFT) and digital collectives?

We'll give you a 30,000 foot view here, but to really get in the know on crypto, you probably need to work through our full 45-minute module.

Sign up here.

INTRODUCING CRYPTOS:

Watch this...

SO, WHAT TYPES OF CRYPTO ARE OUT THERE, AND HOW DO THEY WORK?

A currency, according to Investopedia, is "a medium of exchange

for goods and services" or "a system of money".

Cryptocurrencies are digital currencies that are mainly traded online

between people in a "peer-to-peer" economic system. Cryptos can sometimes also be used to pay for things online.

And there's a variety of cryptos...

Coin vs altcoin

Thousands of cryptos exist, and different versions come and go continuously. You have Bitcoin, of course, but any crypto that is not Bitcoin, is considered an "altcoin", an alternative to Bitcoin. Just to name a few well-known ones: you have Ethereum, Binance Coin, Tether, Dogecoin and Polkadot.

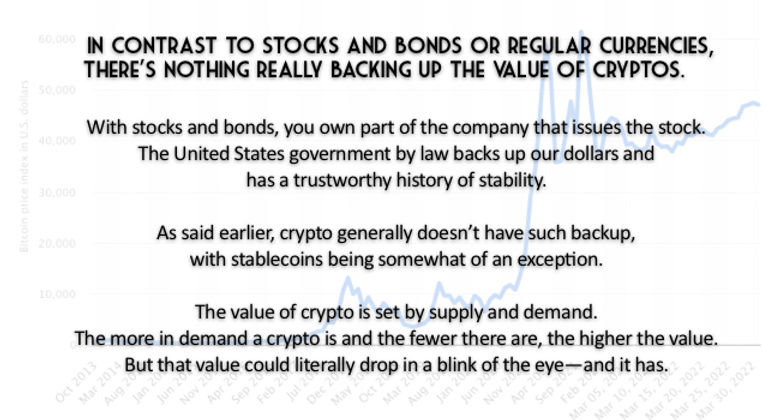

Every crypto has a certain value, that can easily range from $0.0005 to $5k for a coin specifically. And the value of a crypto changes constantly and rapidly (for most cryptos).

Tokens

Tokens are generally cryptos that are "under development," and potential investors (who are willing to take a greater risk for potentially greater gain) may use an established crypto they own (like Ethereum or Bitcoin) to invest in a token, a new to-be-developed crypto. This is called an "Initial Coin Offering", or ICO for short.

After enough seed money is collected, a token usually develops their own blockchain platform. After the blockchain platform is created, the token becomes a coin. Investors getting in this game hope to gain on their investment after the new token/coin becomes popular.

Anyway, ICO's receive many warnings from experts and market regulators, as there are many investment risks associated.

Stablecoins

A few different cryptos have set values. For instance, Tether is pegged to the US Dollar, and values fluctuate very closely around the $1 mark. These cryptos are called stablecoins, and their purpose is to provide stability on the cryptocurrency market.

Stablecoins potentially could be used as a good digital currency, a real usable tender (form of payment), in our American economy. Most stablecoins are under strict supervision by the NY State Department of Financial Services, where $1,000 in their safe is actually 1,000 tokens released for sale. That said, it is more likely that governments will develop their own (stable)coin, like Europe developing a digital version of the EURO, or the recent talks about the US doing the same.

CRYPTOS HAVE DIFFERENT VALUES THAT CAN CHANGE VERY RAPIDLY.

They can easily gain or lose a couple hundred dollars in value, literally in a few short hours.

Watch this...

But before you get into crypto, what do you know about investing, period?

Do your research and homework, starting with this article on learning how to invest.

That said, a couple of key investing rules you should stick to, always:

1.

Develop an "Investing Budget & Strategy."

A good rule to follow: Don't ever invest more than you're willing and can afford to lose!

2.

Turn off your emotions before you dive in.

3.

Take stock warnings seriously.

If this is too vague, refer to this MarketWatch article for extra info.

4.

Learn proper investing skills, starting with a few mock programs.

5.

Be wary of (f)influencers.

They have a different agenda, and generally are out to make money. Do your own research into any potential investment, always.

MOST CRYPTOS RUN ON THEIR OWN BLOCKCHAIN NETWORK.

Simply put—blockchain is software that is a lot like a ledger. Think of blockchain as a book or spreadsheet where transactions are recorded.

People make their own computers—called nodes—accessible for these transactions.

Every time a transaction is recorded by a miner, that person wants to be compensated and will charge a small fee, a miner fee (or "gas" for Ethereum). These fees can range and vary quite a bit, so research different cost and fees properly before diving in.

DEFI:

DECENTRALIZED FINANCE

Bitcoin, the first crypto, was created out of unhappiness with the banking system right at the start of the financial crisis and bank bailouts of 2008.

The creators wanted to find a way to send money over the internet by providing an alternative payment system that would operate free of central control, but otherwise be used just like traditional currencies.

This is the fundamental idea behind DeFi, decentralized finance: an independent financial system that theoretically does not rely on intermediaries such as government agencies or central banks, other banks, brokers, or exchanges to transfer money and services from one party to another.

The result? Transfer fees are eliminated.

Statue of Satoshi Nakamoto,

supposedly the creator of Bitcoin.

Watch this...

Major downsides to crypto?

DID YOU SAY RISKY INVESTMENT?

At FoolProof, we're not the only ones who think that...

Check out the *warning message* Investopedia has on EVERY crypto-related article on their website:

"Investing in cryptocurrencies and other Initial Coin Offerings ("ICOs") is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs.

Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein."

What does that tell you...?

THE LAST REAL DOWNSIDE...?

HACKS & SCAMS!

Check out these examples:

Pump & dump schemes...

Crypto "rug pull" scams...

Celebrities and crypto...

SO, YOU'RE STILL CONSIDERING CRYPTO...

WHAT'S A GOOD WAY TO START?

If you start searching the web for crypto, you'll get thousands of hits on sites and services trying to get you to open an account and/or download their app or wallet.

So, how do you know what information is reliable and who can you trust? It's hard to see the forest for the trees.

Before you can start collecting your cryptos, you'll need a platform to buy your cryptos, and a wallet to store them in. Finding the right solutions for this is a form of rocket science in itself!

Here are 3 places where cryptos can be bought, sold, and/or traded.

Crypto brokers

Crypto brokers are companies that offer a marketplace where you can buy and sell cryptocurrencies, but you can't trade them. Therefore, the cryptos you buy will be deposited directly into your personal crypto wallet. Brokers also enable you to buy or sell just a partial piece of a crypto coin.

A broker is kind of a middle man between the investor and the crypto market. Thus, the focus of brokers is to make it easy to buy and sell cryptos.

Good to know: In the U.S., brokers who convert crypto to fiat currency, such as U.S. dollars, must also be licensed to operate.

Two caveats around brokers:

1. Brokers set their price around cryptos, and that price doesn't necessarily follow the live market value of a coin or token.

2. Brokers can drop unpopular coins from their platform (you'd know if you read the fine print before signing up for their service). If you happen to have some money invested in a dropped coin, you probably lose your invested money.

Crypto exchanges

Crypto exchanges are different from brokers. There are different kinds of exchanges but generally they are online platforms that enable users to buy, sell, trade, and store different types of cryptos. These transactions happen peer-to-peer, which means they go directly from customer to customer not through an intermediary such as a broker.

Buying crypto in peer-to-peer (P2P) sales

Crypto brokers and exchanges match crypto buyers and sellers anonymously. There are some P2P exchange services that provide a more direct connection between users. After creating an account, users can post requests to buy or sell crypto, including information about payment methods and prices. Users then browse through listings of buy and sell offers, choosing the trading partners with whom they wish to transact.

You'll realize P2P sale may be a good idea after we compare centralized vs. decentralized exchanges next... ;)

Exchanges can be centralized, or decentralized.

What's the difference, and why should you care?

Centralized:

These exchanges are private platforms, where people trade their cryptos to one another (peer-to-peer). They are pretty safe exchanges because they require "Know Your Customer" (KYC) registration and identification, and you can better keep track of your crypto and transactions. They're the easier and safer way for beginners to start investing in crypto.

Decentralized:

These exchanges require no registration or identification, and any person or organization can trade their crypto here and use it in any way they want. This may make it cheaper to trade but also less safe (and legal). Flashing stop sign! Always remember decentralized exchanges are riskier than centralized exchanges.

Risky, like so...

When you're ready to dive in, which service or wallet do you choose?

You've got a variety of wallets. And they can be hot or cold, custodial, or non-custodial, etcetera. Let's check 'em out...